November 18, 2022

International accounting made easy In recent times, cross-border transactions have become quite easy thanks to the new-age accounting firms that have made international transactions a cakewalk. […]

Do you like it?

November 18, 2022

Congratulations to Helen, Matt, Ricky, Rachel an Shab, who have all been recognised across a number of awards for Small Business Brilliance. Helen Provart, Peak Translations […]

Do you like it?

November 18, 2022

This week we celebrate four alumni who have all been accredited incredible awards. Congratulations to Johnathan, Paul, Tricia and Shab. Johnathan Sanderson, Corecom Consulting, Leeds | […]

Do you like it?

July 19, 2022

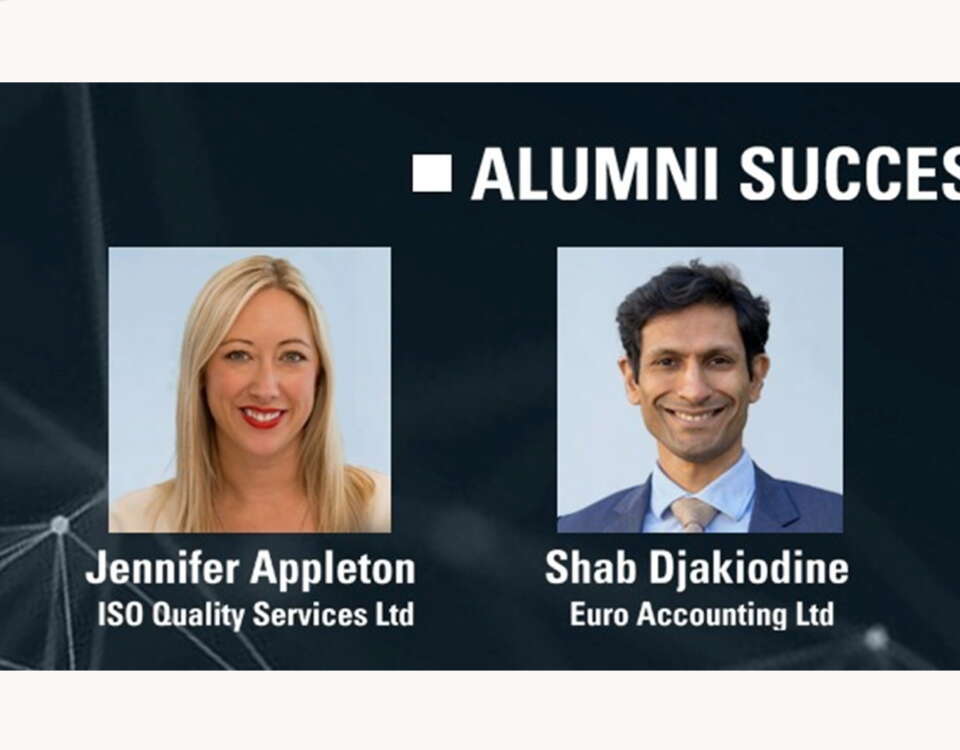

Huge congratulations to Jennifer and Shab for being recognised with these awards! Jennifer Appleton, ISO Quality Services Ltd, Worcestershire | National Cohort 8 Management consultants, ISO […]

Do you like it?

June 22, 2022

This week we celebrate three alumni who have all proven the power and capabilities of small business. Congratulations Shab, Jason and Wayne! Shab Djakiodine, Euro Accounting Ltd, […]

Do you like it?

April 21, 2022

If you’re unhappy with your accountant then get in touch with Euro Accounting. They’re a 10KSB business alumni that we switched to 12 months ago from […]

Do you like it?

February 26, 2021

The UK’s furlough scheme was implemented in March 2020 – the same day that a national lockdown was announced. The speed and urgency of its creation […]

Do you like it?

January 5, 2021

Will the furlough scheme being extended until April 2021 provide enough job security for the UK? What is the furlough scheme and what is its […]

Do you like it?

December 23, 2020

A report by ECA International has revealed that London is the sixth most expensive place in the world. The latest cost of living report has revealed […]

Do you like it?

November 12, 2020

Coronavirus Business Interruption Loan Scheme (CBILS) CBILS aims to financially assist small businesses which have been affected by the pandemic to access loans of up […]

Do you like it?

November 3, 2020

Planning to recruit from the EU in 2021? From 1 January 2021, recruitment is changing for UK companies. The introduction of Brexit means new conditions […]

Do you like it?

September 23, 2020

Brexit may cause the closure of bank accounts for British expats around Europe Tens of thousands of British are affected: expatriates in EU risk to have […]

Do you like it?

September 2, 2020

Guidelines to launch your business in France In this guide we consider the different business structures, company incorporation and the formalities of business registration. The […]

Do you like it?

August 24, 2020

Businesses and taxpayers can expect in the Brexit transitional period to looks at the subsequent potential VAT and customs issues In the wake of the Brexit […]

Do you like it?

June 9, 2020

The number of frauds regarding the furlough system has increased these last weeks. Indeed, a lot of employers are now taking advantage of the “Furlough” […]

Do you like it?

May 27, 2020

In office environments, corporate security is highly regulated; but what about working in remote which is more and more common today? In fact, when we look […]

Do you like it?